Blog

- home

- >

- Blog

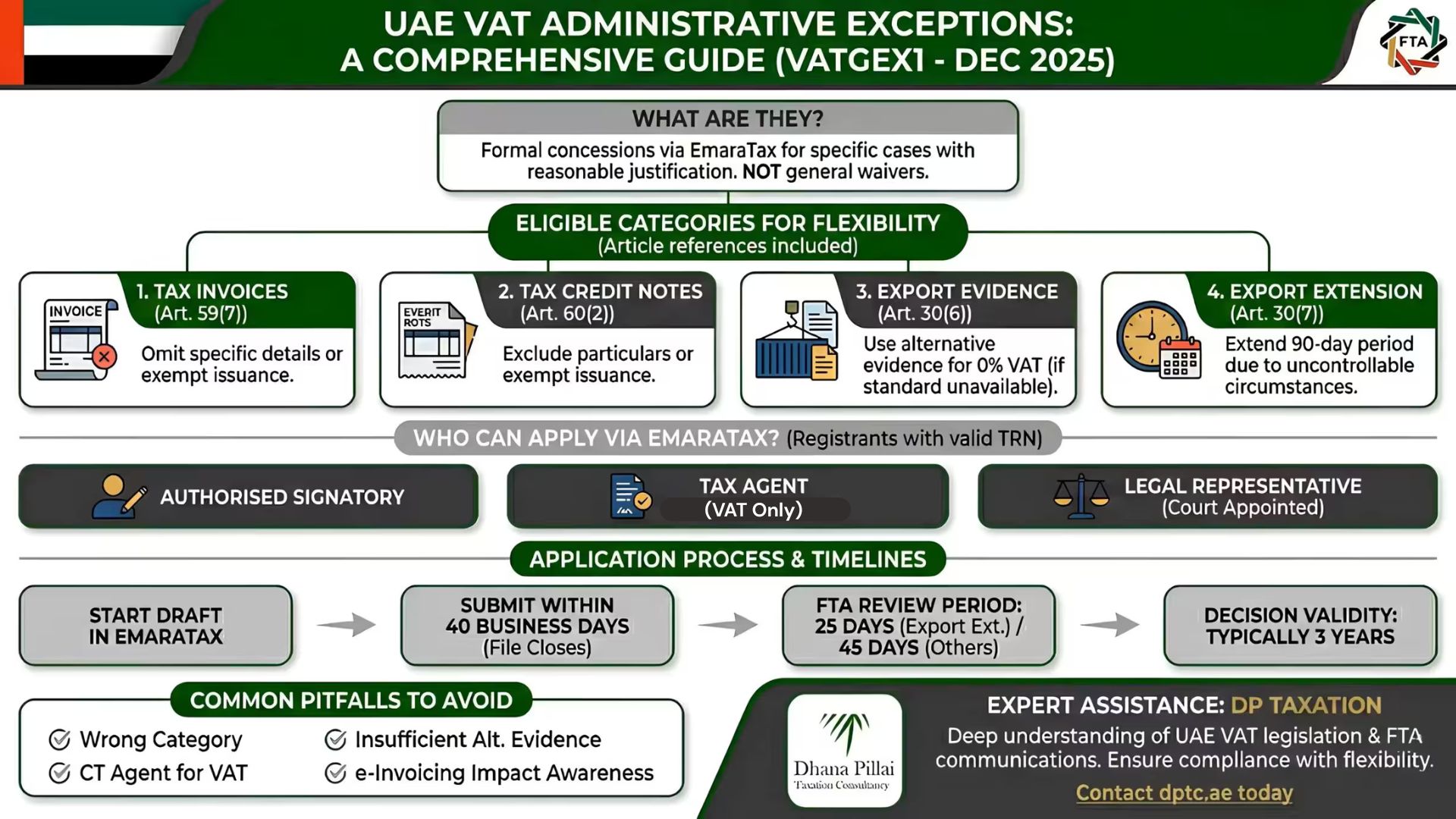

UAE VAT Administrative Exceptions: 2025 Guide & Process

Navigating the complexities of UAE VAT compliance can be

challenging for even the most diligent businesses. While the Federal Decree-Law

No. 8 of 2017 on Value Added Tax, which we call the "VAT Law," sets

strict standards for documentation and timelines, the Federal Tax Authority

(FTA) recognizes that unique business circumstances can sometimes make full

compliance impractical.

To address these challenges, the FTA provides a mechanism

known as Administrative Exceptions.

This guide, based on the latest VAT Administrative Exceptions Guide (VATGEX1) released in December 2025, outlines how your business can request flexibility in specific areas of VAT compliance.

What are VAT Administrative Exceptions?

An administrative exception is a formal concession granted by the FTA that allows a Registrant to deviate from certain standard requirements of the VAT Law and its Executive Regulation. These are not general waivers, they are only granted for specific cases where a business can provide "reasonable justification" as to why meeting a legal obligation is impossible or impractical.

Eligible Categories for Administrative Exceptions

The scope of administrative exceptions is limited to four primary categories where the FTA may allow flexibility:

- Tax Invoices (Article 59(7)): You can submit a request to omit specific mandatory details from a Tax Invoice, or even request to be exempt from issuing or delivering a Tax Invoice in certain scenarios.

- Tax Credit Notes (Article 60(2)): Similar to invoices, businesses can request to exclude certain particulars or be exempt from issuing or delivering Tax Credit Notes.

- Alternative Evidence for Export of Goods (Article 30(6)): If your business cannot obtain the standard official or commercial evidence required to prove an export, you can request the use of alternative documentation to support 0% (zero-rating) VAT.

- Extension of Export Period (Article 30(7)): Standard rules require goods to be exported within 90 days of the date of supply. A business may request an extension if circumstances beyond their control prevent them from meeting this deadline.

Note: Administrative exceptions do not apply to VAT registration, VAT refunds, or the waiver of administrative penalties.

Who Can Apply?

Only Registrants, meaning Taxable Persons with a valid TRN, are eligible to apply. The application must be submitted through the EmaraTax portal by one of the following authorized individuals:

- The Authorised Signatory of the Registrant.

- A Tax Agent listed specifically for indirect taxes, such as VAT.

- A Legal Representative appointed by a court.

In the case of a Tax Group, only the authorized signatory of the representative member or the group's appointed Tax Agent can submit the request.

The Application Process and Key Deadlines

To ensure a successful application, businesses must follow a structured process in EmaraTax.

- Preparation of Supporting Documents: You must provide a formal cover letter on company letterhead explaining your business background, the specific exception requested, and the "reasonable justification" for the request.

- Submission Timeline: Once a draft is initiated in EmaraTax, you have 20 Business Days to receive a reminder and 40 Business Days to finalize and submit the request, or the FTA will close the file.

- FTA Review Period: The FTA generally responds within 25 Business Days for export extensions and 45 Business Days for all other categories.

- Validity: If granted, the exception is typically valid for three years from the decision date.

Common Pitfalls to Avoid

The FTA frequently rejects applications due to administrative errors. Common mistakes include:

- Submitting the request under the wrong category.

- A Tax Agent only listed for Corporate Tax (CT) attempting to submit a VAT exception.

- Failing to provide alternative documents that contain sufficient information to prove the export of goods.

- Requests regarding e-Invoicing: Be aware that exceptions for Tax Invoices or Credit Notes will expire once the Electronic Invoicing System is fully implemented.

Expert Assistance with DP Taxation

Applying for an Administrative Exception requires a deep understanding of UAE VAT legislation and the ability to present a compelling case to the FTA. At DP Taxation, we specialize in managing complex FTA communications and ensuring our clients remain fully compliant while utilizing the flexibility provided by the law.

Are you unsure if your business qualifies for a VAT Administrative Exception?

Contact dptc.ae today to review your case and manage your EmaraTax submissions.

- Dhana Pillai